An efficient hotel payment solution is the cornerstone of any successful hotel business. It’s critical to a property’s cash flow, operations and guest satisfaction. So, why are so many hoteliers reluctant to embrace modern payment solutions and their many benefits?

In episode four of Matt Talks, Mews CEO, Matt Welle, discusses some of the challenges and opportunities facing hoteliers who embrace a modern payments solution. This article explores some of the highlights, but you can watch the full episode here:

Watch the episode

Better Cash Flow

Managing cash flow is a significant challenge for hotels, especially when relying on Online Travel Agencies (OTAs) like Booking.com or Expedia. The shift toward virtual cards has made this even more complicated. In the past, nonrefundable bookings allowed hotels to collect payments upfront. But today, virtual cards issued by OTAs can often only be charged on the guest’s arrival or departure, delaying cash flow and putting the hotel at risk.

With embedded payment solutions like Mews Payments, hoteliers can regain control of their cash flow by driving more bookings directly through their websites. Nonrefundable bookings provide instant revenue, ensuring predictable income even if guests don’t show up.

Think about how the airline industry does things. You buy your ticket in advance for a particular day, and you pay for it up front. Airlines rarely offer flexible rates, and when they do, they come at a premium. Hoteliers should consider adopting a similar (though softer) pricing model to secure more upfront payments; non-refundable should be the default price, with flexibility at an extra cost.

Preauthorization for Lower Credit Risk

A significant credit risk for hotels comes from guest no-shows or invalid credit cards. Modern payment systems like Mews Payments reduce this risk by automating preauthorization. Even if a guest books with a flexible rate, the system can automatically charge the room rate and preauthorize a set amount for incidentals upon their arrival.

Tokenized credit cards provide an extra layer of security. If a guest spends more during their stay, hotels can easily increase the preauthorization without requiring additional steps from the guest. This reduces credit risk and ensures the hotel is always covered financially.

Automated systems can detect invalid credit cards before the booking is finalized. If a card is flagged as invalid during tokenization, Mews immediately notifies the hotel, enabling them to cancel the reservation and reduce financial risk.

Capture upsells and guest details

Embedding payments throughout the guest journey can help to mitigate the profit-margin loss when guests book through an OTA. Sending pre-arrival emails for online check-in also gives you the opportunity to upsell – and, crucially, capture tokenized payment details so you don’t have to wait until arrival to see the cash flow from any extras.

And by the way, this is also a great opportunity to capture guests’ genuine email addresses, rather than the masked versions you receive through OTAs. This means you can target them directly with marketing and convert them into return guests through direct bookings. Read how Mews helps capture real guest email addresses from OTA bookings.

Improving the Guest Experience with Automation

Perhaps the most exciting aspect of modernizing payment processes is the improvement in guest experience. Automating payments saves time and reduces the need for awkward, time-consuming conversations about credit cards and bills at check-in.

By implementing Mews, hoteliers can integrate online check-ins where guests provide payment information in advance. For the majority of guests, this means they won’t need to discuss payments at all during their stay. This shift allows staff to focus on upselling experiences like spa treatments or city tours and having real conversations, rather than handling financial transactions. What used to be a four- or five-minute check-in can now be reduced significantly, giving staff more time to engage with guests and enhance their stay, or getting guests to their rooms faster.

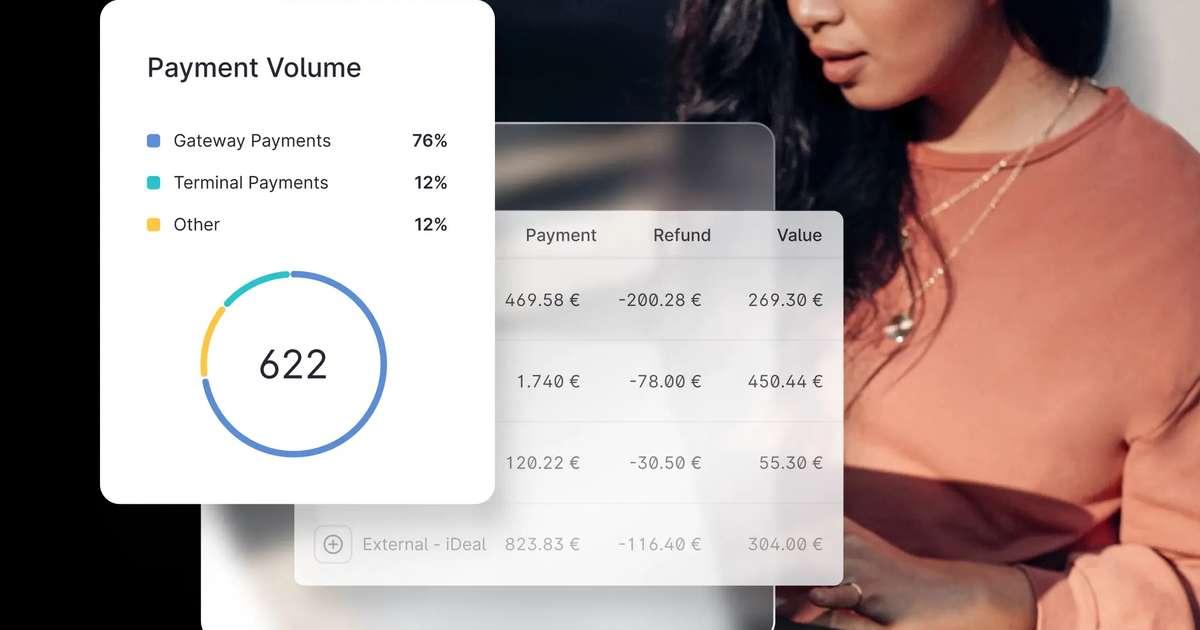

The Power of Embedded Payments

Mews Payments does more than just process transactions. It streamlines workflows, secures payments and enhances cash flow, all while improving the guest experience. With embedded payments, hoteliers can reduce credit risk by using tokenized and secured payment methods, ensuring that invalid cards are caught before a booking is finalized.

Furthermore, automating these processes frees up your team to focus on delivering remarkable service. Instead of getting bogged down with financial tasks, your staff can interact with guests, offer personalized recommendations and drive more revenue by upselling relevant services.

So, when is the best time to upgrade your hotel’s payment system? You know what they say: there’s no time like the present.

Want to know more about how Mews Payments works?

Take a video tour

About Mews

Mews is the leading platform for the new era of hospitality. Powering over 5,500 customers across more than 85 countries, Mews Hospitality Cloud is designed to streamline operations for modern hoteliers, transform the guest experience and create more profitable businesses. Customers include BWH Hotels, Strawberry, The Social Hub, and Airelles Collection. Mews was named Best PMS (2024) and listed among the Best Place to Work in Hotel Tech (2021, 2022, 2024) by Hotel Tech Report, as well as World’s Best Hotel PMS Provider (2023) and World’s Best Independent Hotel PMS Provider (2022, 2023) by World Travel Tech Awards. Mews has raised $335 million from investors including Goldman Sachs Alternatives, Kinnevik and Revaia to transform hospitality.

www.mews.com

Please visit:

Our Sponsor